Affordability

At Rose State, Your Dollar Works As Hard As You Do.

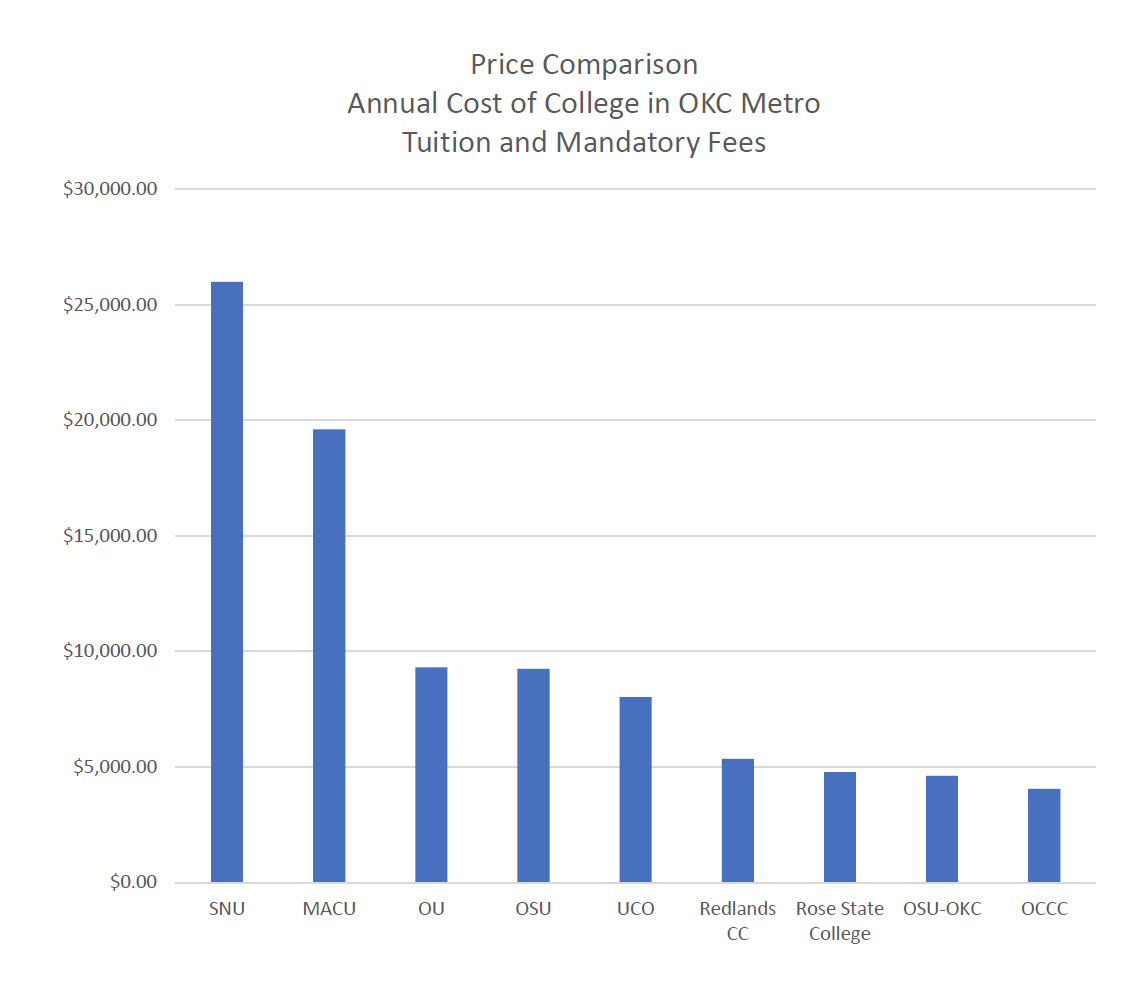

Continuing your education doesn’t have to break the bank. At Rose State, we offer the courses you need to take the next step in your career without taking on loads of debt. The graph below shows how Rose State stacks up, dollar-for-dollar, against other local colleges.

This graph, and the table below, shows the cost of 2021-2022 in-state tuition and fees for 30 credit hours at OKC-are colleges and major universities.

|

College |

Cost |

|

SNU |

$26,000.00 |

|

MACU |

$19,604.00 |

|

OU |

$9,311.40 |

|

OSU |

$9,243.00 |

|

UCO |

$8,030.10 |

|

Redlands CC |

$5,355.30 |

|

Rose State College |

$4,775.10 |

|

OSU-OKC |

$4,613.40 |

|

OCCC |

$4,058.70 |

You can save almost $7,000 to over $10,000 by starting and completing an associate degree at Rose State before transferring to an Oklahoma public, four-year university. Or, begin working right away with degrees designed for immediate employment, such as in the medical field, engineering technology, or as a paralegal. Whatever college path you choose, it will be an investment that pays off in your career and future earnings.

Where is your money going?

At Rose State, your dollars work as hard as you do.

- 21 to 1 student-to-faculty ratio

- 57 degrees to fast-track your career

- Over 22 million dollars awarded in financial aid annually

- A state-of-the-art library filled with computer resources.

- Tutoring services.

- Small class sizes for personalized support. NO large auditorium-style classes.

Rose State College – Going Somewhere Starts Here!

Apply now – www.rose.edu